Services

Asset Management

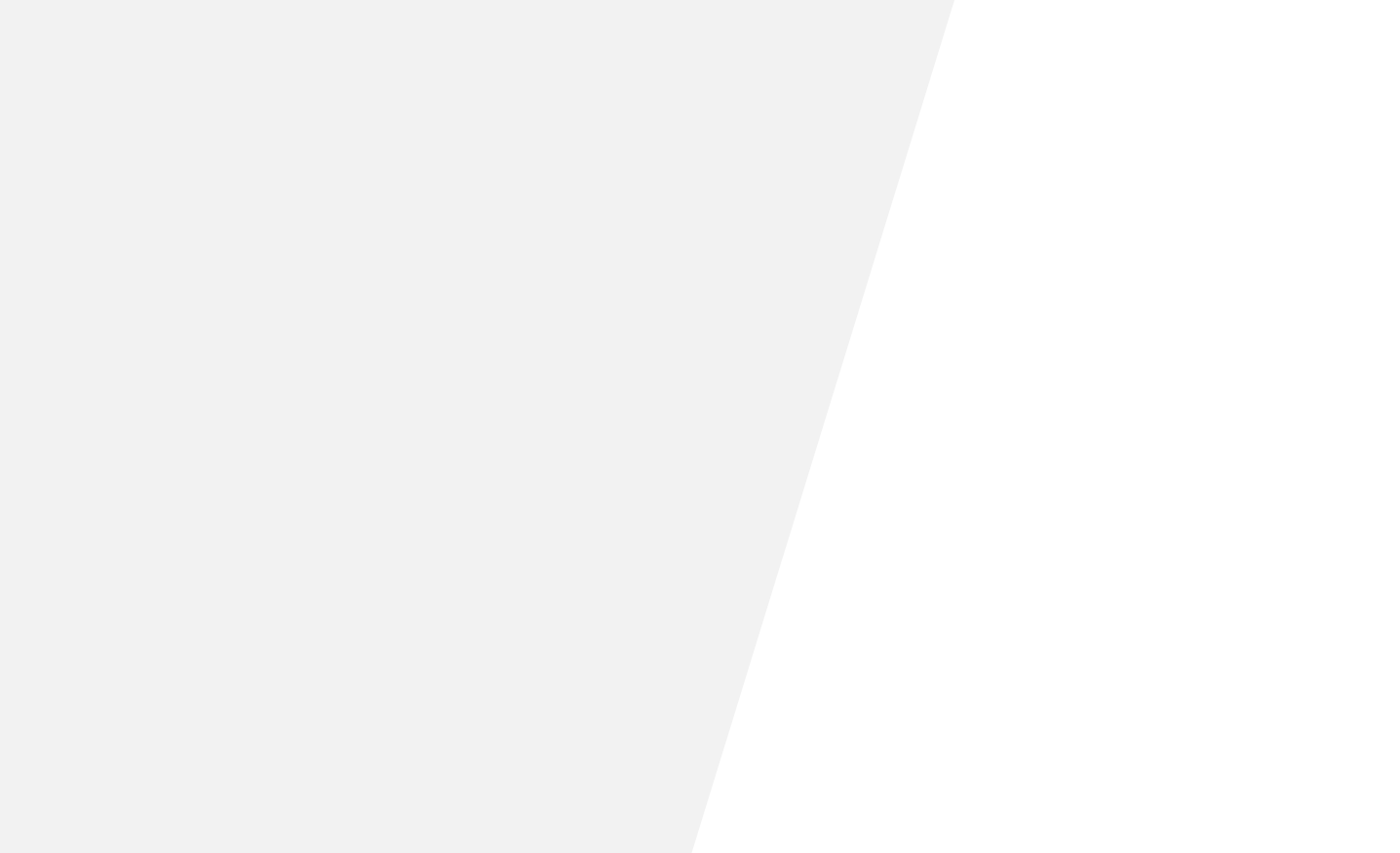

OUR CLIENTS BENEFIT FROM AN INSTITUTIONAL QUALITY ASSET MANAGEMENT OFFERING, AND A BESPOKE ASSET ALLOCATION DESIGNED AROUND THEIR OBJECTIVES, TIMELINES AND RISK APPETITE

We aim to generate strong risk adjusted returns by investing in liquid and listed securities across asset classes.

We invest in securities which we believe are under-priced and/ or are expected to appreciate due to a catalyst including regulatory changes, change in business model, post-bankruptcy or a corporate event such as restructuring, capitalisation or spin-off. Risk management and scenario analysis underpin all our investment decisions.